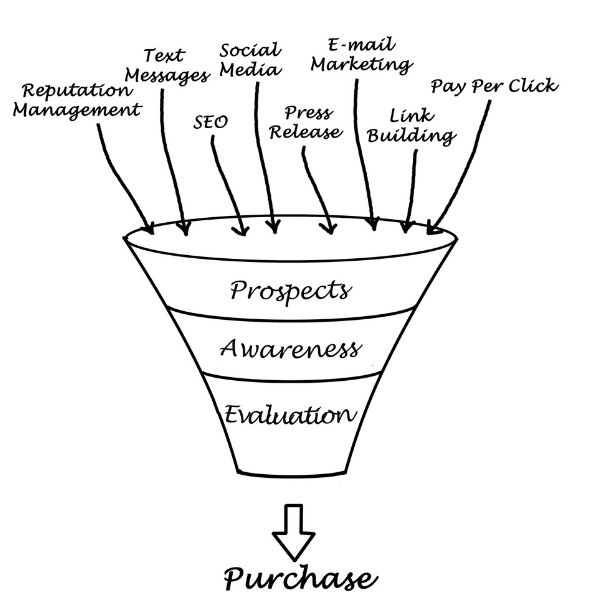

On an average, BCG confirms that an insurance customer goes over 5 to 7 touchpoints. The sad part is that these internal departments don’t talk to each other. They operate in silos. This not only turns off the customer, but insurance brands lose on many selling opportunities. So, the primary agenda for insurance marketers is to maximize revenue and to cut across scattered data with a Customer Data Platform.

Customer Data Platform for Insurance marketers

Customer Insights

Cross-cutting silos to achieve moment-based marketing and maximizing revenues

Policy renewals are all about the right timing. These time-bound and frequency-driven transactions require highly focused and close knitted customer journeys. FirstHive’s CDP is designed to eliminate channel communications that are redundant and non-converting and deduce them to most relevant customer journey paths.

We made it easy for brands to travel through the customer journey, cross-cutting the silos.

Scattered Data Results in Poor Customer Experience

As the number of leads increase, cost spent on acquiring each lead brings a pattern. Most times the total cost spent on leads multiplies with the increasing lead inflow. Lead qualification is a process that brings down such costs. FirstHive’s CDP was used by this leading insurance company to formulate and orchestrate customer journeys. This helped in tightening lead qualification and reducing costs.

Solve all insurance marketing challenges with a CDP. Find out more.

Increased the conversion rates by

40

Eliminated invalid leads from the call center, reducing costs.

70

The Difference

Enabling hyper targeted cross-sell and up sell campaigns

Learn MoreSee in LIVE how to use FirstHive for insurance marketing? Schedule a 1:1 session.

How to improve your insurance business with a CDP?

Real Time Tracking & Multi Channel User Journey Orchestration

Customer journey orchestration for lead qualification

CDP gave the call center a better and complete view of customer and prospect activities. This immediately helped the call center employees prioritize their calls. FirstHive’s CDP was deployed to orchestrate multiple customer journeys. This helped the call center personnel identify the journey and attribute the right qualification. This was also available to be deployed for new leads and prospects.

Customer journey orchestration helped their prospects either purchase the insurance policy online or through a straightforward process. The new process also helped the team at call center to expedite the purchase process while assisting through with a valid OTP sent to the prospect’s phone number at a preferred date and time.

Unified View of Customers

Integrated channels for unified customer journeys

With FirstHive deployment this leading insurance company was able to create a single customer journey for policy renewals. This helped them reach out to customers in a timely manner through the right communication channels. It further helped them restrict the outreach, bringing down costs. All this had a direct impact on increasing and closing policy renewals, successfully.

The CDP deployment enabled synchrony among multiple communication channels. It reduced overload of communications to customers leading to greater customer experience for insurance policy renewals.

Hypersonalization for Upsell

Reduced overload of communications to customers

Call center employees were more cognizant of the conversation that could have happened with Relationship Manager or Sales personnel. They could also spot where the customer dropped off if trying to purchase online and help accordingly. They could upsell or cross sell products when they were speaking to existing clients.

FirstHive with its Hyper-Personalization feature also enabled them to plug in Upsell of a relevant product in the renewal campaign. This ensured that with one campaign, the marketer was able to upsell different products to different customers basis the logic set in Hyper-personalization.

Maker-checker feature

Campaign correction and create sharper and complex segments

FirstHive understands that Enterprise Campaign execution demands a good Quality Control methodology and thus they configured the Maker-Checker feature for Royal Sundaram wherein campaigns set by agencies or team members can be validated by the respective owner. This ensured timely corrections in campaigns.

Short URLs

Multi-Product Renewal tracking

FirstHive also enables insurance marketers to automate the renewal campaigns for different products basis configuration of independent logic set for each product. This ensured absence of manual effort in designing separate campaigns for each product.

CDP for Insurance

Impact-driven and wholesome deployment

All this had a direct impact on increasing and closing policy renewals, successfully. The CDP deployment enabled synchrony among multiple communication channels. It reduced overload of communications to customers leading to greater customer experience for insurance policy renewals.